Our financial planning clients know that one of the great concerns during financial independence (retirement) is the uncertainty regarding healthcare costs. In fact, for the past twenty years or so we have modeled healthcare costs using a 6% annual inflation rate, twice the general rate of 3%. I still recommend this, however, there is the possibility that new technologies can have a deflationary effect or at least a disinflationary effect. Dr. Peter Diamandis shares some relevant and interesting information on his tech blog in a piece called Revolutionizing Healthcare.

Have you been hearing about blockchain technology? Are you confused? I came across some pretty good information from the folks at IBM, including an e-book titled Blockchain for Dummies. You’ll need to provide your contact information to IBM in order to get the e-book, but IMHO it will be worth your time if you want to understand what the big deal is. Click here.

Investment reports are posted.

If you are an investment management client of Financial Planning Associates, Inc., your preliminary 2nd quarter reports have been posted to your secure web portal. During the 2nd quarter, our clients’ average total return was +0.38%. During the same period, the total return of the Dow Jones Industrial Index was -0.73%. Final reports will replace the preliminary reports after June inflation information becomes available. During the quarter the worst return experienced by one of our investors was -1.56% and the best return was +4.33%. It should be noted that the calculation used to determine our clients’ returns is called the internal rate of return. It is cash flow specific and is net of all fees and expenses. It represents the average return experienced by our investment clients, from the most conservative to the least conservative who were invested during any portion of the period. Typically, our younger clients experience returns greater than the average while our most conservative investors experience results that are lower. Investment return information is provided by Morningstar using GIPS standards.

“Retiring early is difficult.” This is a sentence that many of my financial planning clients have heard me say. A recent study has confirmed my statement. View it here.

Free orchestra concerts! The Gateway Festival Orchestra is a fifty-piece professional orchestra based in St Louis. Each summer they perform 4 free concerts at the Washington University Brookings Quadrangle. It’s a good way to enjoy a warm St Louis evening. Details are here. Send us a note if you plan to attend, and would like to connect. You should bring a lawn chair or a blanket. And perhaps a small cooler with liquid refreshments.

How long will you live? This question is always discussed in the context of financial planning because in order to provide necessary cash flow during retirement it is useful to consider how many years of funding will be necessary. Quite often I recommend that my client(s) consider that they will live longer than they first assume. Perhaps many years longer.

One interesting question to be considered is whether there is a natural limit to human lifespans. We know that some living things tend to live much longer than humans, and others tend to have short lifespans. The life insurance industry currently uses age 120 as the assumed maximum human lifespan when calculating life and annuity insurance premiums. Certainly, we see plenty of evidence that the average human lifespan has increased over the past several hundred years. But, is there a natural maximum? We can’t be certain, however, a recent study would seem to support the idea that there is no maximum. You can read about it here.

How often should you buy a new car? As with many questions having to do with cash flow, asset values, etc. the best immediate answer is, “It depends.” A good, more specific answer can be determined in the context of a financial planning review. Years ago I read a book with the title The Millionaire Next Door, which pointed out that quite often the truly wealthy people you might meet do not drive particularly expensive cars or wear expensive watches. There is no absolute conclusion to be drawn by this except that perhaps for most of us “investing” our money in non-appreciating assets may not lead to becoming a millionaire.

So, I came across a news piece with the title, Americans Holding Onto Their Cars Longer Than Ever, which reports that (as of 2015) the average age of vehicles on the road has climbed to an all-time high of 11.5 years. You can read the piece here. Does this mean that you should drive your car for 11.5 years? No. Your situation is YOUR SITUATION, which may be very different from that of your neighbor. But the information does indicate that for most of us the cost of owning and operating a vehicle is not inconsequential. But you probably knew that.

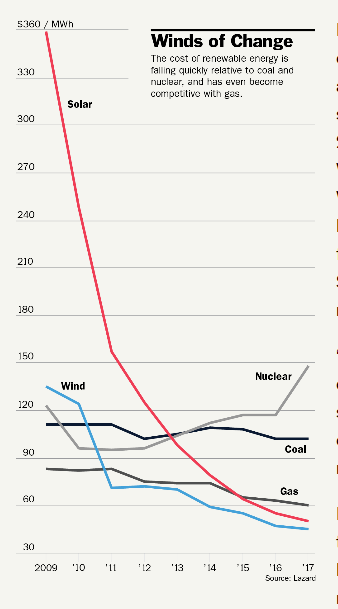

How Batteries Will Change the Power Business. This is the title of a recent cover article published in Barron’s. The author points out that a “tidy, quiet town in central Massachusetts” now attracts visitors from around the globe who come to see the batteries that have made Sterling, Mass. the country’s energy storage leader. The bottom line is that improvements in battery technology along with the decreasing cost of solar and wind power are leading to cost savings for individuals and power companies. You can find the article here, but it may require a subscription to view it.

The strange reason owl theft may be on the rise. How can a thief steal cash when there isn’t much cash around? Details here.

Maryland to Other States: Stop Sending Us Your Dirty Air. As reported in the Wall Street Journal, Maryland and several other Eastern states have petitioned the EPA to force upwind states to reduce their air pollution. “We are literally in a position where we can’t control ozone in our own state,” said Tad Aburn, director of Maryland’s Air & Radiation Administration. “The only thing we can do is try to force upwind states to reduce emissions.” The story is here.

Air pollution contributes significantly to diabetes. That’s the conclusion drawn from a new study done by the Washington University School of Medicine as reported in the MedicalXpress. See here.

If you are contemplating a divorce you should consider this: The Tax Cuts and Jobs Act changes the rules regarding the deductibility of alimony payments for agreements made after December 31, 2018. Details here.

Financial Planning Associates, Inc. is an investment adviser, registered in the State of Missouri. As such we are required annually to offer to provide a copy of the current version of our adviser’s brochure and privacy policy to our clients. These documents are continuously posted on this website. You can locate them toward the bottom of the front page in the Quick Links area. They are entitled Brochure and Privacy Policy, respectively.

Occasionally a financial reporter will call our office when gathering information for a publication. In the past, I have been interviewed for Business Week, the St Louis Post Dispatch and a few others. Recently a reporter called to discuss a piece which was published by the Associated Press. It is common for publications to reproduce content first published by the Associated Press and in this case, the article was reproduced in the quite a few publications, among them the US News and World Report, Fox Business News, LA Times and others. The title of the piece is Open Up More Than the Books With Your Financial Adviser. If you are interested in reading the article you can find it here.

If you have recently logged on to your web portal you will have noticed that Morningstar has made some formatting changes. All of the information that you are accustomed to seeing is still there, and some new information is now at your fingertips as well.

And finally, a little humor.

A farmer counted 196 cows in his field, but when he rounded them up he had 200.

*****

“Has your son decided what he wants to be when he grows up?” I asked my friend.

“He wants to be a garbageman,” he replied.

“That’s an unusual ambition to have at such a young age.”

“Not really. He thinks that garbagemen work only on Tuesdays.”

*****

I spotted several pairs of men’s Levi’s at a garage sale. They were sizes 30, 31, and 32, but I was looking for size 33. So I asked the owner if he had a pair. He shook his head.

“I’m still wearing the 33s,” he said. “Come back next year.”

*****

At a job interview tell them that you are willing to give 110%. Unless the job is for a statistician.

*****

If you think eggplant is good, you should try any other food; it’s much better.

Thanks for reading!